by Alexa Rosas|staff writer

Shar Huffman and her fellow Johnson counselors upload college funding information to their twitter accounts as senior David Wolff works day in and day out at Popeyes, despite the fact that he hates chicken. College is the typical destination for high school graduates, but the cost may make college appear impossible. Reality is that attending college is a possibility for all with scholarship and financial aid opportunities.

“There is always a way to go to school,” Johnson counselor Shar Huffman said. “It’s just a matter of going through the process.”

Students are collecting all of the loans, grants, and scholarships they can get their hands on.

“I am looking into scholarships, loans, student aid; everything really,” Wolff said.

Scholarships are one source of financial assistance for college hopefuls.

“I haven’t really done too much research on college yet,” Wolff said,“But I am planning on applying to any scholarships that are available to me.”

Scholarship opportunities are everywhere. The Johnson counselors have a twitter account (@ctjguidance) where they post up to six scholarship probabilities a day in addition to all of the search engines, such as “fast web,” which is designed specifically for the search for scholarships. But, students must be be careful.

“You just have to be a little cautious,” Huffman said, “Because these sights have created a whole market for people who want to make money too.”

With all of the stress backpacking students they are forced to get jobs and learn to become independent from their parents.

“I worked at Popeyes for a while so that I could help my parents out,” Wolff said.

The hard work and responsibility placed on students is launching them into adulthood.

“My eyes have been opened to a reality that money pretty much is everything, and if you can’t pay; you really have no future,” senior Akira Buckner stated.

Work-study jobs are another way that many students are paying for college. One’s probability of getting a work-study job depends on that student’s financial need. The payment, which is hourly for undergrads and a salary for grad students, is encouraged to be used to pay for schooling.

“I think a good job would be working on campus, because that’s pretty much guaranteed,” Buckner said, “It isn’t like the school will go out of business or anything.”

The average cost of college typically includes books, tuition, assorted fees, housing, and it usually totals around $21,447 per year at a public college and around $42,225 at a private college. In result, student aid is a necessity for most students.

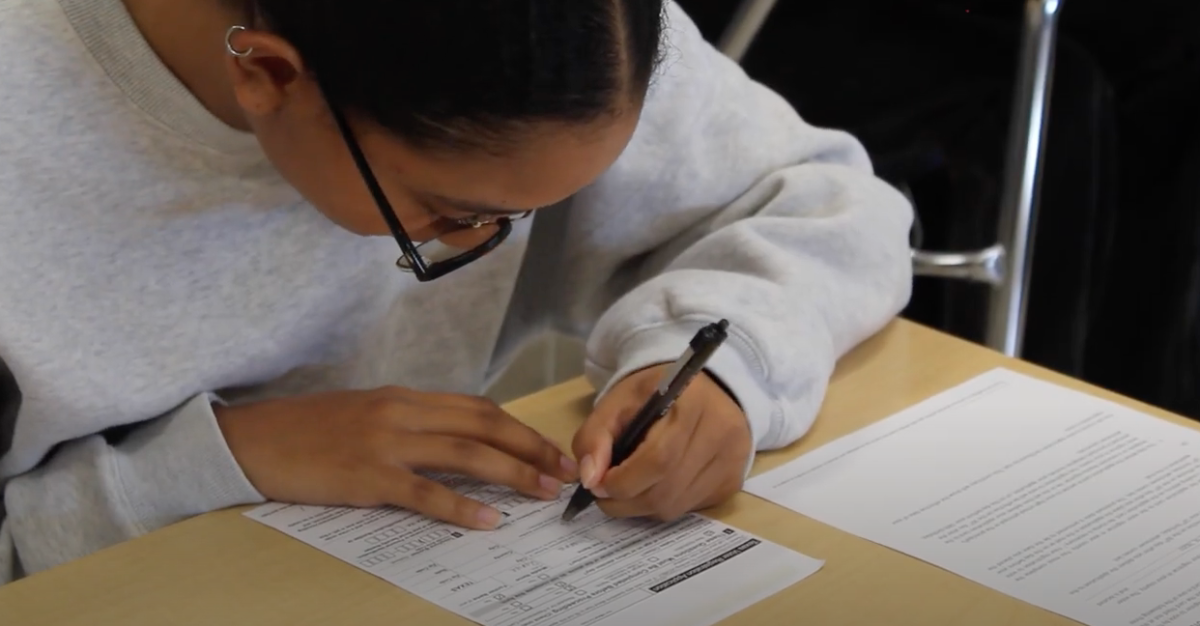

“Going through the government with the FAFSA program is obviously the best way, because the interest will be the lowest,” Huffman said.

FAFSA is the Free Application for Federal Student Aid. This student aid is over $227 billion dollars that is set aside so that the government can assist a student’s college tuition and nearly every student qualifies.

“My parents have been saving for six years and I have been putting away most of my birthday and Christmas money and all of my paychecks for over three years,” Wolff explained.

To students that plan to attend college the financial future can appear ominous, but if someone goes through the process college can be a reality.

“By paying my way I know that I have become more and more responsible and and independent. I am also more aware of how the world works,” Wolff said.