Eduardo Calderon | Staff Writer

As the responsibilties of jobs increase, so does the student awareness of filing their own taxes.

“When you earn an income, the government will tax that income for support like the military, roads, etc.” AP Mitch Brown said.

Filing taxes is not always necessary for each job.

“[Filing taxes] depends on how much money is earned,” senior Rachel Kenney said, “If it’s under a certain amount [of that income] it’s not a big deal.”

Some teens may not recieve their tax returns because of the way it may be filed.

“If parents claim them as a dependent, then those teens file their own tax report, but they wont’t get their tax returns,” H&R Block reperesnative Karen Haws said.

Although the return won’t make it into the teen’s hands, the money will make it into the possession of the family.

“If your parents claim you as a dependent, then your return is added to their own tax return,” Kenney said.

Student teens have an opportunity of obtaining their own personal tax return.

“If parents do not support, or claim their teens as dependents, then those teens file their own taxes and get their own claims,” Haws said.

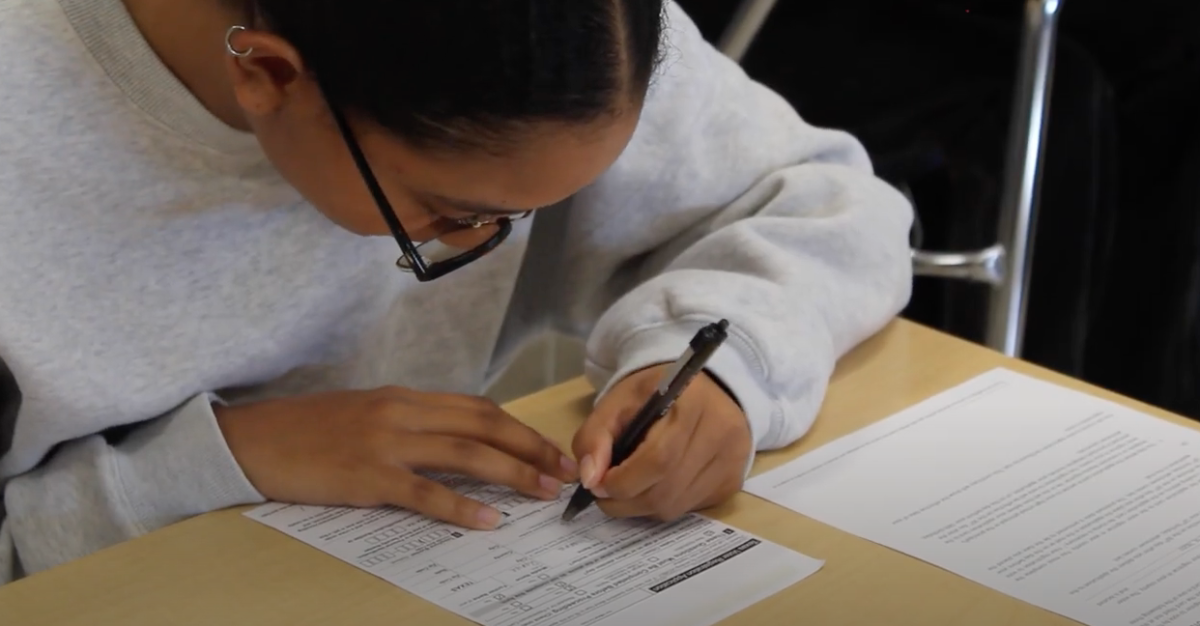

Before tax returns can be mailed out, necessary information about the filer is needed.

“They’re easy forms [to fill out]; there are no real claims for teens, like owning your own house or car,” Brown said.

The forms needed are very simple to fill out, and can be found in any postal service building.

“The 1040ez is the best way to file,” Haws said, “H&R Block is giving 1040EZs away for free.”

Like everything else, filing taxes can be done with a click of a computer mouse.

“Taxes can now be performed electronically,” Brown said.

There are specific sites geared to file taxes, such as www.irs.gov.

“You can go online to a government site and the forms to file taxes are right there,” Kenney said.

With such difficulty and responsibility for filing taxes, it’s always good to seek advice.

“First, consult with someone because there are options for filing taxes,” Haws said.

There is never a need to be confused about taxes, because even parents are experienced filers.

“Always ask questions, to your parents, or other adults so you don’t get into a bind,” Brown said.