Isai Carmona | staff writer

During the late 1400s, Antwerp, or modern day Belgium, was seen as the center of international trade. Merchants bought goods anticipating that prices will rise in order to net them a profit, and the idea of bonds was roughly introduced. Roughly 600 years later, young middle class people find themselves playing the rich man’s game. With all the recent news coverage of the David and Goliath stories, a handful of our society waits proactively for word on whether or not they should invest liquid cash into the market.

William Hoffman, AP-Economics teacher, has his own point of view of how the market is influencing young people around the country.

“Personally I think it’s very very exciting to see young people getting involved,” Hoffman said. “I do worry that a lot of them think that most of the market is like what happened with Gamestop, and that those kinds of things are happening constantly. That was kind of a unique event: which is why there was much news coverage about it.”

Hoffman believes that any person should invest in the market, since investing in a stable company tends to lead to profit as the years go by.

“I love the idea of low cost, practically, no cost online investing.” Hoffman said. “I think it’s a good experience, as long as the people involved understand the risk they’re taking.”

Hoffman encourages students to take the jump, as long as they do understand the risk.

“You do have to understand that when you invest, you’re taking a risk,” Hoffman said. “There are a lot of long term benefits to getting started young. There is also very much risk of loss.”

When the market was first introduced in the United States, accessing it was nearly impossible for the common man: considering that one would need thousands of dollars to get started. With all the new access to the market, Hoffman is more than willing to encourage students to invest in their future.

“I am very glad that access to the market has expanded, and the cost of doing business on the market has come way way down because of competition; especially, online competition.” Hoffman said. “All in all, I think it’s good that more people are trying it.”

Still one thing that must be understood is that the stock market is not a get rich quick scheme. Hoffman emphasizes that no one should put in more than they can lose.

“I do worry that young people don’t understand the chances for loss.” Hoffman said. “I would not invest any money that I would be dramatically harmed if I lost.”

After Reddit users came together and helped drive a rise in Game Stop’s stock price during the last days of February, forcing halts in trading and causing a extreme loss for the short sellers betting against it and banking on the stock falling.

Over the month of January, GameStop Corp. rose over 900% in stock increase.

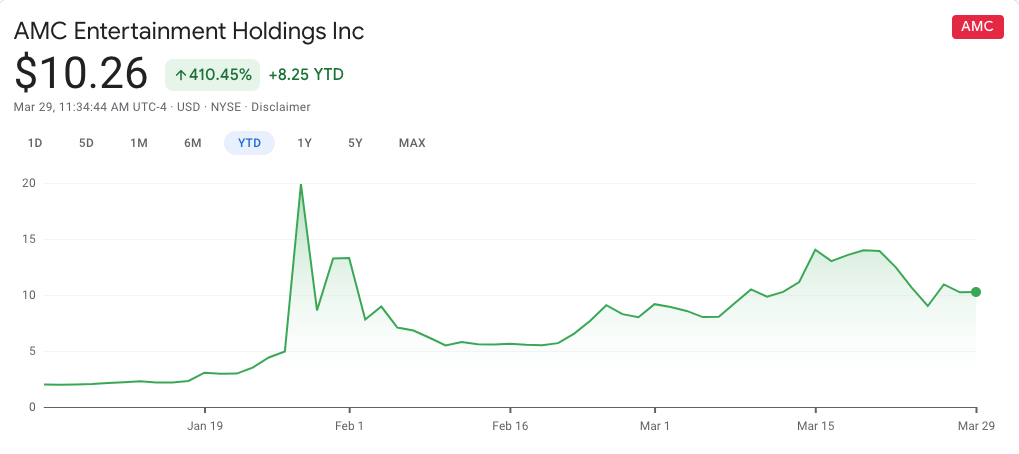

Close to the end of January, Stock prices for AMC increased by over 400% following the announcement of opening dates.

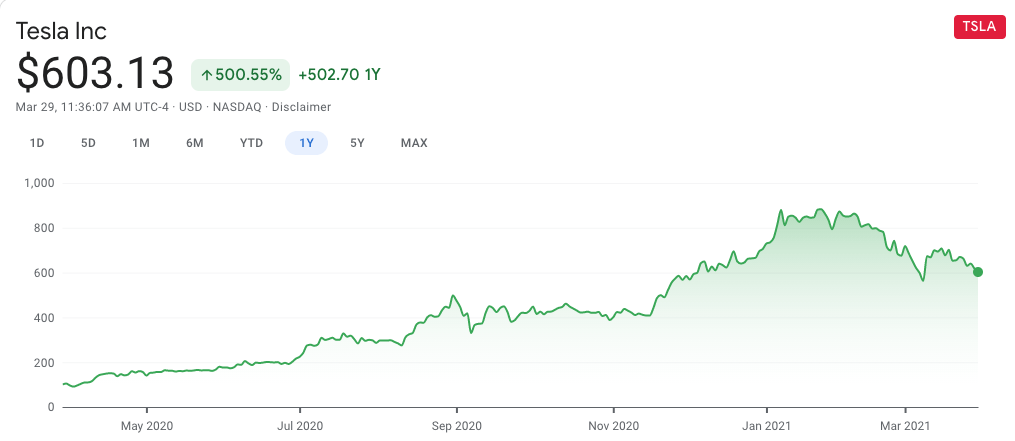

Tesla, over the course of the year 2020, increased by over 500%.